Financial literacy is an important life skill, yet it remains one of the most overlooked aspects of a young person’s education. South Africa’s youth, who make up more than one-third of the population, are stepping into adulthood in a financial landscape fraught with challenges. With youth unemployment at 45.5% and 62% of take-home pay going towards servicing debt, the reality is that young people are making critical financial decisions without the right tools to navigate them. The question is, how do we equip them with the knowledge they need?

We live in an age of instant gratification. Whether it’s food delivery, streaming services, or online shopping, everything is designed to be fast, engaging, and effortless. Financial literacy, on the other hand, is often seen as tedious, complex, or even intimidating. This is where gamification, the integration of game-like elements into educational content, can transform financial education from a chore into an engaging and rewarding experience.

Making financial literacy interactive

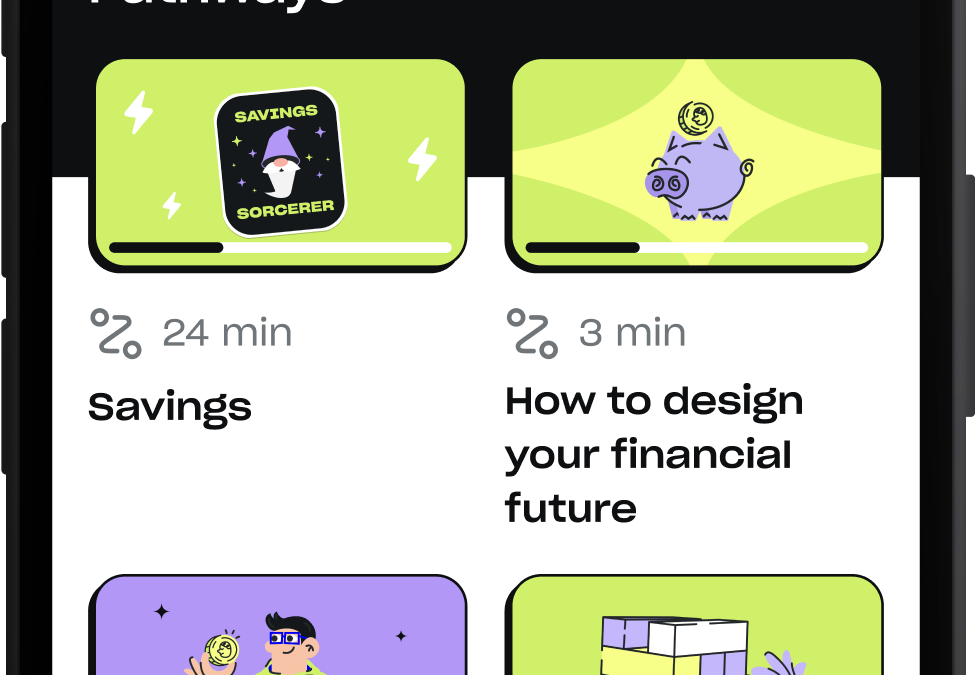

Platforms like Blackbullion South Africa are incentivising learning through interactive lessons, quizzes, and achievement badges, encouraging young users to engage with financial concepts in a way that feels intuitive. Covering topics like budgeting, saving, debt, and investing—alongside real-life challenges such as student finance and scams—the goal is to make financial literacy second nature before bad financial habits take root.

Studies show that financial education at an early age leads to better long-term financial decisions. Yet, many South Africans enter adulthood without ever learning how to budget, save, or manage credit. Instead, they are met with enticing payday loans, high-interest credit cards, and the illusion that ‘buy now, pay later’ is a sustainable way to live. By the time reality sets in, many are trapped in a cycle of debt that is difficult to escape.

A transformational approach

Blackbullion South Africa, lead by WaFunda, is providing a much-needed intervention. In 2025, WaFunda will continue as the consumer financial education partner to the Sanlam Foundation, granting 20 000 urban South African youth 12 months of access to financial education through the platform. These individuals often come from financially excluded backgrounds, where financial literacy means personal success, economic survival, and upward mobility.

“A financially literate youth population contributes to economic stability, reduces dependency on credit, and encourages a culture of informed financial decision-making,” says Tshepo Kgapane, Product Lead at Blackbullion. “When young people understand the long-term impact of their money choices, they are less likely to default on loans, fall into unmanageable debt, or make impulsive financial decisions.”

On 27 March 2025, Blackbullion SA and the Sanlam Foundation will host their annual Flipside of the Coin webinar, unpacking what young South Africans are really experiencing when it comes to money, from debt struggles to the financial stress of living on a tightrope.

Key highlights include:

- How financial anxiety is affecting youth.

- The difference between “knowing” and “doing” when it comes to money habits.

- How organisations and delivery partners can become part of the solution.

Online registration: bit.ly/FlipSideoftheCoin2025

So, could the gamification of money be the key to keeping our youth financially independent and out of debt? The evidence suggests it’s a step in the right direction. By transforming financial education into something engaging, interactive, and rewarding, we’re giving young South Africans the opportunity to take control of their financial futures—one ‘bullion’ at a time.