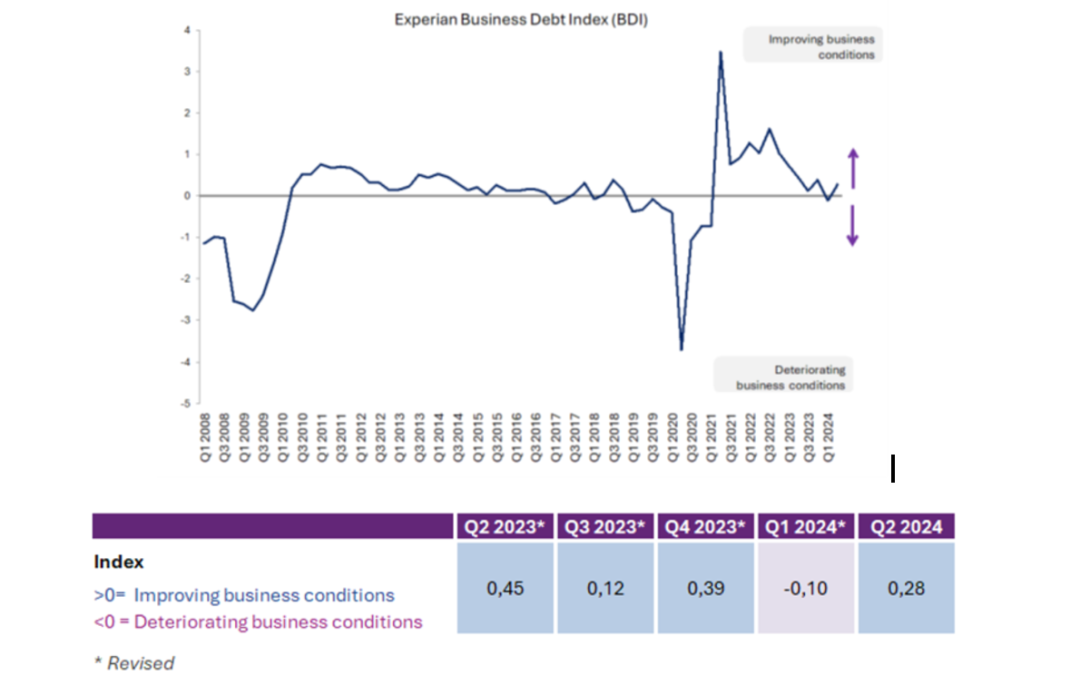

Business confidence in South Africa is on the rise, fuelled by a halt in load-shedding and a more optimistic economic outlook. This positive sentiment and reliable electricity supply has led to an increase in the Business Debt Index (BDI) – returning to levels signifying improving business conditions. The Experian BDI improved to a positive 0.28 in Q2 2024, up from -0.10 in Q1 indicating better business conditions.

Positive shift in payment behaviour

South Africa’s Gross Domestic Product (GDP) growth was modest at 0.4% in Q2, higher than the 0.0% recorded in Q1. However, the most significant contributor to the BDI improvement was the notable drop in debt age ratios. Businesses, no longer hampered by power outages, settled debts faster, reflecting renewed economic confidence.

“The absence of load-shedding enabled businesses to repay debts more efficiently,” says Jaco van Jaarsveldt, Head of Commercial Strategy and Innovation at Experian Africa. “This, coupled with a more positive business sentiment and prospects of declining inflation and interest rates, drove the BDI upswing.”

A sharp decline was recorded in both the 30 to 60 days debt age ratio and the 60 to 90 days debt age ratio. The former fell from 26.0% to 21.6%, and the latter from 11.0% to 6.6% from Q1 2024. This is indicative of a meaningful improvement of debt repayment behaviour within agreed payment terms.

Improvement across various sectors

The overall improvement in business debt conditions was reflected across most sectors. Seven out of the nine sectors tracked by the BDI showed positive momentum, highlighting the broad-based nature of this recovery. This positive trend was particularly evident in sectors like electricity (as expected – considering the absence of load shedding) and transport and communication.

However, the construction sector remains a cause for concern, continuing its downward trajectory as the weakest performer, with its BDI deteriorating further in Q2. “The lack of infrastructural investment, exacerbated by the disruptive influence of criminal elements within the construction industry, continues to plague the sector,” adds van Jaarsveldt. “This highlights the need for urgent government intervention and policy reforms to revive this vital sector.”

Agriculture, another sector facing headwinds, experienced a setback in Q2. Despite a brief recovery in Q1, the sector’s GDP growth was reversed due to challenges including foot-and-mouth disease and persistent drought conditions, impacting its ability to meet debt obligations.

Cautiously optimistic outlook

Economic forecasts from International Monetary Fund (IMF) predict South Africa’s economic growth rate to reach around 1.5% next year and 2% in 2026. The elimination of load-shedding, a business-friendly political landscape, and potential interest rate cuts are expected to bolster the economy.

“If these positive trends persist, and we see further strengthening of the Rand and increased confidence in South Africa’s economic prospects, the country’s economic growth could exceed current expectations,” concludes van Jaarsveldt.

The latest BDI report highlights resilience and optimism in South Africa’s business landscape. While challenges remain, the improvement in debt conditions, driven by a confluence of positive factors, signals that there are green shoots of optimism in the country’s economic outlook. Continued collaboration between the government and private sector is essential to unlock the country’s full economic potential.